Parenting comes with financial challenges, especially understanding our kids' spending habits. Teaching them to save early isn't just a parenting choice; it's an important investment in their financial future. Limited financial knowledge affects more than just their piggy bank—it impacts their education, career, and independence. Our Budgeting Worksheets for Kids are here to help, providing a practical tool to teach financial responsibility.

I started with the allowance routine with the requirement of doing chores. She saves for what she wants, but now she's more focused on her desires. This led to a chat about what matters most to her. To teach budgeting, I made simple bilingual budgeting sheets for elementary school kids.

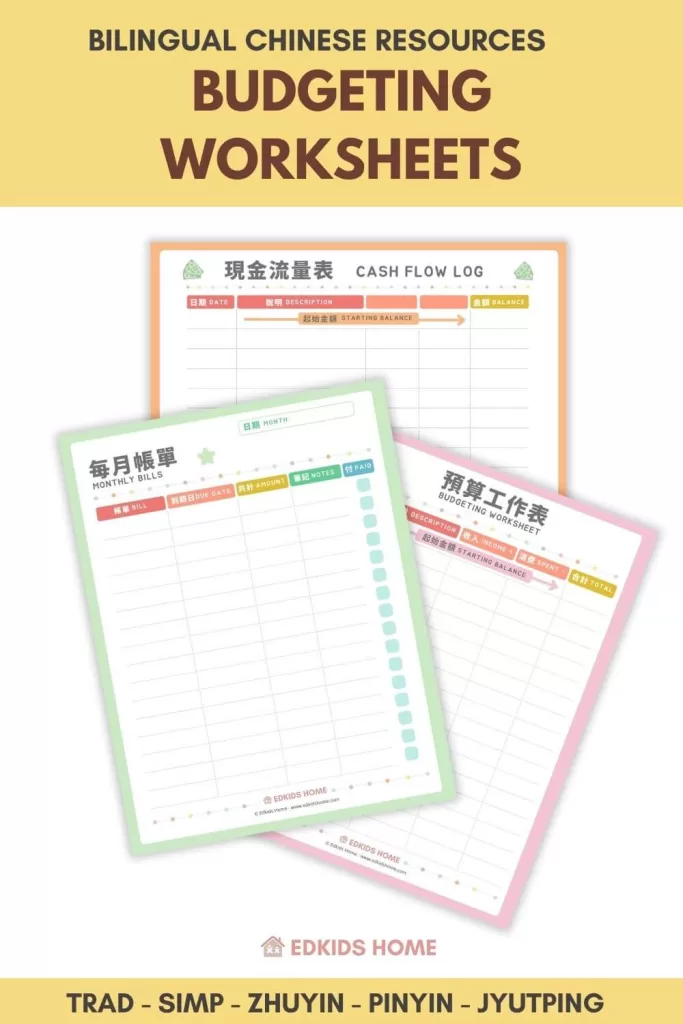

Created for elementary school children, our budgeting worksheets, available in English and Bilingual Chinese (Traditional, Simplified, Zhuyin, Pinyin, Jyutping), help establish the basics of budgeting.

How Do You Teach Kids About Budgeting?

Understanding the Purpose

“We never had a budgeting worksheet when we were kids! Why start now?” Well, times change and so do the financial landscapes that our children will grow into. Teaching them the value of money and how to manage it early on can prevent financial headaches down the line. By using these worksheets, kids develop skills such as critical thinking, planning, and delayed gratification.

Introducing Budgeting in a Fun Way

Learning to handle money doesn't have to be boring. We've added game-like features to our worksheets, turning budgeting into an exciting journey instead of a task. Children can anticipate securing their financial independence as they get older.

We came up with four categories that she can save money towards:

- Health Care

- Education

- Give / Donation

- Spending

To add some fun, I picked up these adorable oversized clear Lego boxes to match each category. I used my Cricut machine to create labels for each one.

Here are more ideas on how to sort out the categories:

- Jars

- Envelopes

- Drawer Dividers

- Wallet Sections

- Mini Folders/ Binders

- Tin Cans

- Containers

Health Care

This is where the money goes for doctor's appointments, medicines, and other health-related expenses. It's essential to teach kids early on that taking care of their health is a priority and requires financial planning.

Education

Investing in education is investing in the future. This category includes funds for school supplies, extra-curricular activities, and even college savings if your child is old enough.

Encouraging them to save for their education can instill a sense of responsibility and motivation.

Give/Donation

Teaching children the value of generosity and giving back is crucial. By including this category, kids learn that money isn't just meant for themselves, but also for helping others in need. This can promote empathy and compassion in young minds.

Spending

Allowing children to have a category for spending money teaches them how to manage their wants and needs. They can use this saved money for treats or small purchases, but they also learn that it's essential to budget and save for these things rather than impulse buying.

Budgeting Rule

To keep it simple for my daughter, she will put in the right amount into the health care, and education, then give/donation boxes. Then let her add the remainder into the spending box.

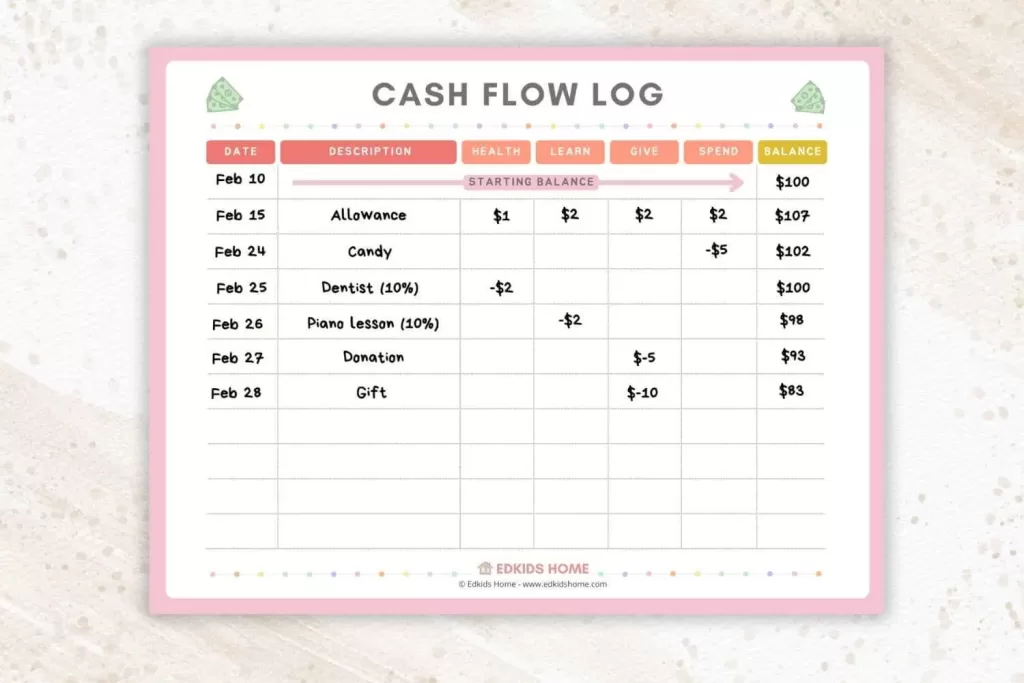

Here is an example of how she distributes her $7 allowance for the week:

- Health Care – $1

- Education – $2

- Give/Donation – $2

- Spending – $2

This breakdown keeps things balanced. It helps my daughter focus on important areas like healthcare and education, teaches generosity through giving, and sets aside some for personal spending. Adjust the amounts as needed based on your family's values and financial goals.

For older kids, use it as an opportunity to teach them the 50/30/20 Budget Rule that recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

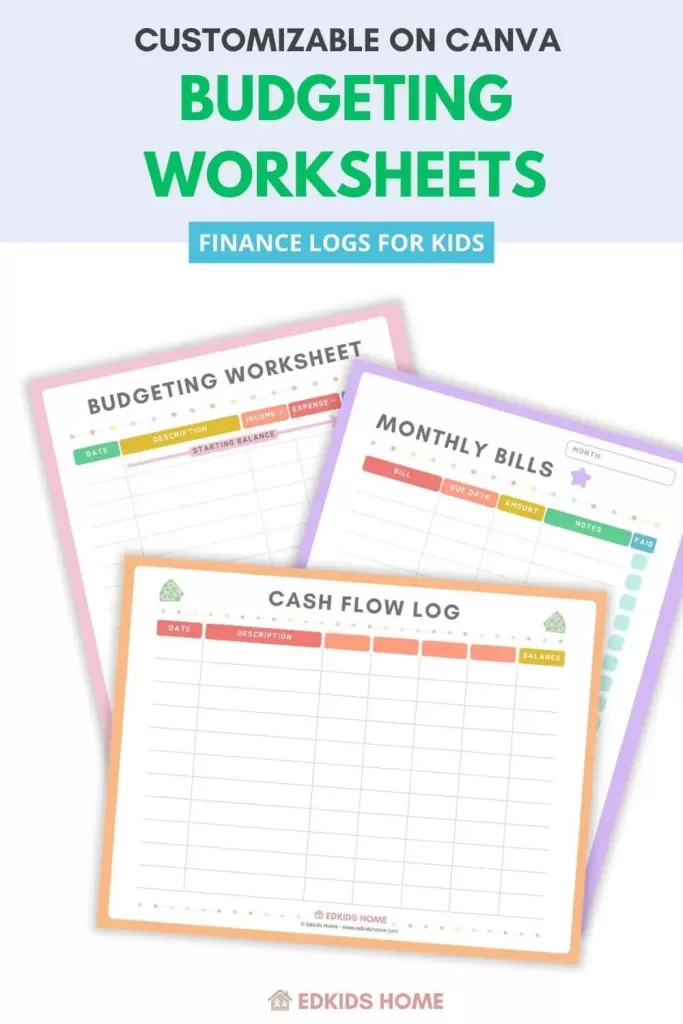

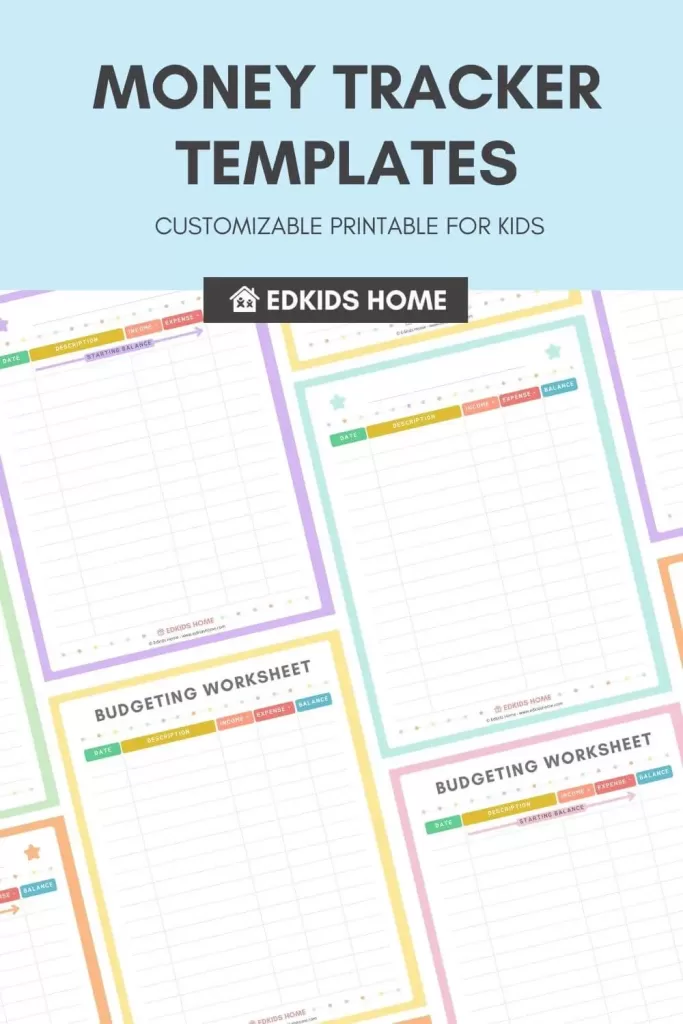

Our Budgeting Worksheets Set for Kids

Age recommendation: 6+ years old

File format: pdf

We have created the following worksheets in our set:

- Budgeting worksheet

- Cash flow log printable

- Monthly bills printable

Language available:

- English

- Bilingual Chinese

- Traditional

- Simplified

- Traditional Pinyin

- Simplified Pinyin

- Zhuyin

- Jyutping Cantonese

We offer various color options: pink, light orange, light blue, light green, light teal, and lilac.

You can easily edit these using Canva (free to use)! Customize them as you like and feel free to use them for your own needs!

Categories Budgeting Worksheets

We have created four categories of budgeting worksheets to keep track of their health care (health), education (learn), Give/Donation (give), and spending (spend) – one to match each Lego box.

Additionally, we've made a basic budgeting worksheet and a blank budgeting worksheet for those with specific categories to use with their child.

Begin by involving children in conversations about what they need and want to spend money on. The Categories worksheet helps kids recognize and distribute their money among specific categories like toys, gifts, and doctor visits. This way, they start thinking about how they plan to spend their money.

Cash Flow Log

The Cash Flow Log is an exercise in recording where money is coming from and where it's going. Children can use this sheet to keep track of any money they receive, whether it's an allowance or payment for chores. It also encourages them to think about how they spend their money and if there are ways they could save.

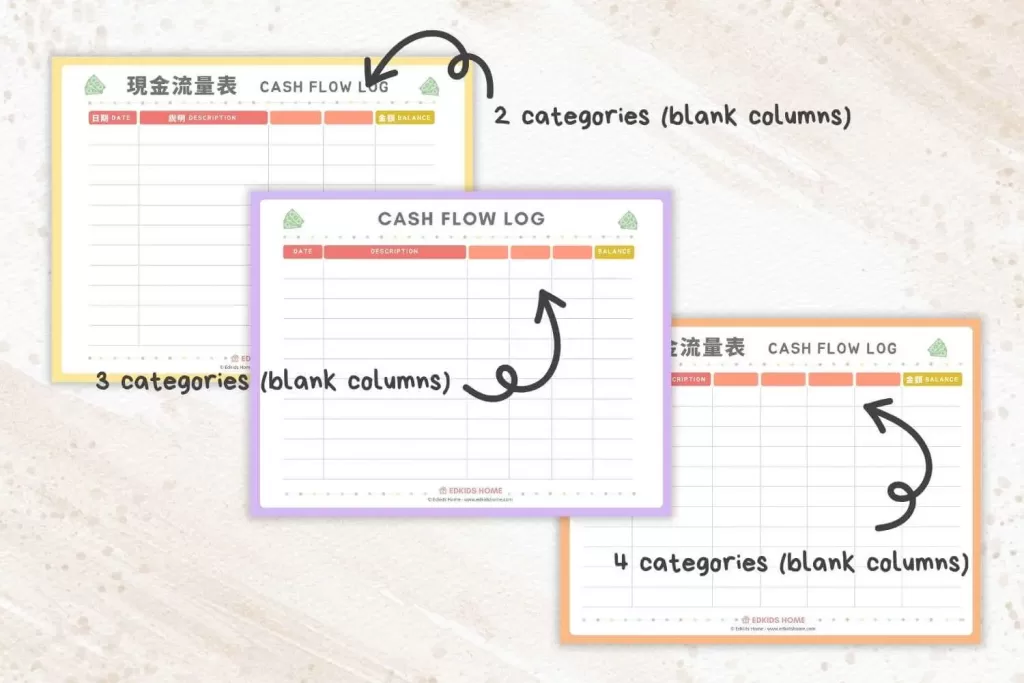

Additionally, we've made a basic cash flow log and blank column cash flow logs for those with specific categories to use with their child.

For the blank columns, you can customize which categories you would like to use for your child.

We have cash flow log templates with two, three, and four blank columns that you can choose.

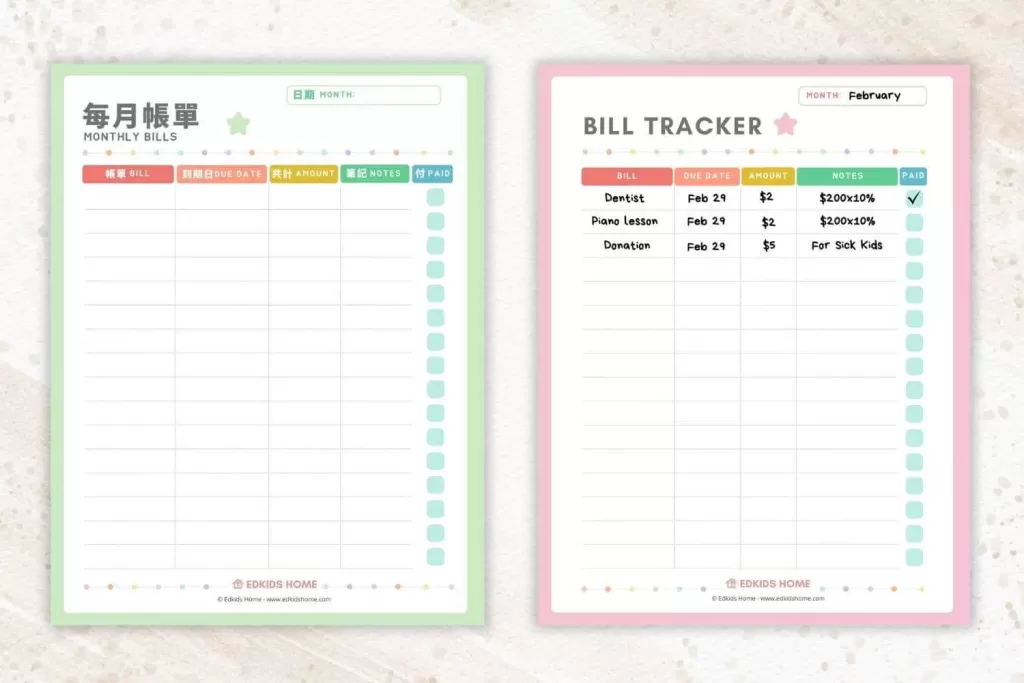

Monthly Bill

The Monthly Bill worksheet introduces the concept of recurring expenses. You can work with your children to fill in this section, listing regular bills like piano lessons or their dental visits. It's a wake-up call to the realities of adult life – in a kid-friendly way.

Creating a Budgeting Routine for Kids

Routines are the backbone of thriving systems. We encourage parents and kids to schedule regular budgeting sessions to update and iterate on the worksheets. It's not a one-and-done event; it's an evolving, continuous conversation about money.

For our family, we schedule allowance paydays every other Sunday, right after completing our chores. This is when we bring out the budgeting worksheets and fill in the necessary updates.

Additionally, I'll provide my daughter with the monthly bill printable to indicate the specific bill she needs to contribute to. For instance, for piano lessons priced at $225 per month, she'll be responsible for 10% of it, totaling $2.25.

It's key to stress the importance of money and the responsibility it carries. Engaging children in budgeting helps them learn vital life skills and build a strong financial base for the future. It's also a chance for quality family time!

Last Thing About Our Budgeting Worksheets for Kids

To conclude our budgeting worksheet bundle includes:

- Category budgeting worksheets

- Cash flow log

- Monthly bill printable

Use our budgeting worksheets for kids as a key step to build their financial knowledge and skills. These tools are designed to teach and inspire your children in handling money, preparing them for financial success. Start shaping your child's money habits early on. Get our budgeting worksheets now and begin discussing money with your family today.